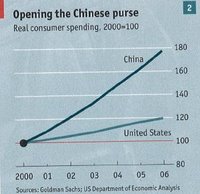

Yesterday I attended a very interesting conference about the world economy. Of course a lot of emphasis was put on China. A lot has been said about China, which includes a lot of non-sense and misinterpretation. One of the reasons being the lack of transparency and reliable statistics. The speed of the boom in China is leaving a lot of casualties behind. Authorities often have hard time collecting relevant information about their industrial activity. The consequences are that it makes the whole macroeconomic analysis very difficult. The key question when dealing with China and trying to forecast what's waiting is the reversal of China's export oriented economy into a self sustained market. All depends obviously on the speed at which domestic demand will become strong enough to not only absorb 100% of the Chinese output but start relying on imports. This is essential because it will not only create stimulus for the US and European economy, but also reverse the balance deficit. The trade deficit in the US will become harder and harder to sustain and it's time to do something. I am always amazed when I hear that the reason for the imbalance primarily comes from the fact that Asian economy save too much. I guess it's always easier to find explanation's somewhere else. This argumentation is an economic non-sense in my opinion. Moreover it projects a wrong assessment of the situation and maintains the belief that $981 billions (yes billions!!!) of foreign reserves being accumulated in the Chinese Central Bank is not really an issue. Guess what??? It is!!!! That is why the reversal is crucial, so I was very happy to finally be able to read an in-depth analysis of the issue in the Economist from October 21st. The Economist is an amazing magazine with high value high quality content and I strongly recommend it if you want to better understand what's going on in the world right now....

Yesterday I attended a very interesting conference about the world economy. Of course a lot of emphasis was put on China. A lot has been said about China, which includes a lot of non-sense and misinterpretation. One of the reasons being the lack of transparency and reliable statistics. The speed of the boom in China is leaving a lot of casualties behind. Authorities often have hard time collecting relevant information about their industrial activity. The consequences are that it makes the whole macroeconomic analysis very difficult. The key question when dealing with China and trying to forecast what's waiting is the reversal of China's export oriented economy into a self sustained market. All depends obviously on the speed at which domestic demand will become strong enough to not only absorb 100% of the Chinese output but start relying on imports. This is essential because it will not only create stimulus for the US and European economy, but also reverse the balance deficit. The trade deficit in the US will become harder and harder to sustain and it's time to do something. I am always amazed when I hear that the reason for the imbalance primarily comes from the fact that Asian economy save too much. I guess it's always easier to find explanation's somewhere else. This argumentation is an economic non-sense in my opinion. Moreover it projects a wrong assessment of the situation and maintains the belief that $981 billions (yes billions!!!) of foreign reserves being accumulated in the Chinese Central Bank is not really an issue. Guess what??? It is!!!! That is why the reversal is crucial, so I was very happy to finally be able to read an in-depth analysis of the issue in the Economist from October 21st. The Economist is an amazing magazine with high value high quality content and I strongly recommend it if you want to better understand what's going on in the world right now.... Friday, October 27, 2006

Changing macroeconomics

Yesterday I attended a very interesting conference about the world economy. Of course a lot of emphasis was put on China. A lot has been said about China, which includes a lot of non-sense and misinterpretation. One of the reasons being the lack of transparency and reliable statistics. The speed of the boom in China is leaving a lot of casualties behind. Authorities often have hard time collecting relevant information about their industrial activity. The consequences are that it makes the whole macroeconomic analysis very difficult. The key question when dealing with China and trying to forecast what's waiting is the reversal of China's export oriented economy into a self sustained market. All depends obviously on the speed at which domestic demand will become strong enough to not only absorb 100% of the Chinese output but start relying on imports. This is essential because it will not only create stimulus for the US and European economy, but also reverse the balance deficit. The trade deficit in the US will become harder and harder to sustain and it's time to do something. I am always amazed when I hear that the reason for the imbalance primarily comes from the fact that Asian economy save too much. I guess it's always easier to find explanation's somewhere else. This argumentation is an economic non-sense in my opinion. Moreover it projects a wrong assessment of the situation and maintains the belief that $981 billions (yes billions!!!) of foreign reserves being accumulated in the Chinese Central Bank is not really an issue. Guess what??? It is!!!! That is why the reversal is crucial, so I was very happy to finally be able to read an in-depth analysis of the issue in the Economist from October 21st. The Economist is an amazing magazine with high value high quality content and I strongly recommend it if you want to better understand what's going on in the world right now....

Yesterday I attended a very interesting conference about the world economy. Of course a lot of emphasis was put on China. A lot has been said about China, which includes a lot of non-sense and misinterpretation. One of the reasons being the lack of transparency and reliable statistics. The speed of the boom in China is leaving a lot of casualties behind. Authorities often have hard time collecting relevant information about their industrial activity. The consequences are that it makes the whole macroeconomic analysis very difficult. The key question when dealing with China and trying to forecast what's waiting is the reversal of China's export oriented economy into a self sustained market. All depends obviously on the speed at which domestic demand will become strong enough to not only absorb 100% of the Chinese output but start relying on imports. This is essential because it will not only create stimulus for the US and European economy, but also reverse the balance deficit. The trade deficit in the US will become harder and harder to sustain and it's time to do something. I am always amazed when I hear that the reason for the imbalance primarily comes from the fact that Asian economy save too much. I guess it's always easier to find explanation's somewhere else. This argumentation is an economic non-sense in my opinion. Moreover it projects a wrong assessment of the situation and maintains the belief that $981 billions (yes billions!!!) of foreign reserves being accumulated in the Chinese Central Bank is not really an issue. Guess what??? It is!!!! That is why the reversal is crucial, so I was very happy to finally be able to read an in-depth analysis of the issue in the Economist from October 21st. The Economist is an amazing magazine with high value high quality content and I strongly recommend it if you want to better understand what's going on in the world right now....

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment